About Kosh24

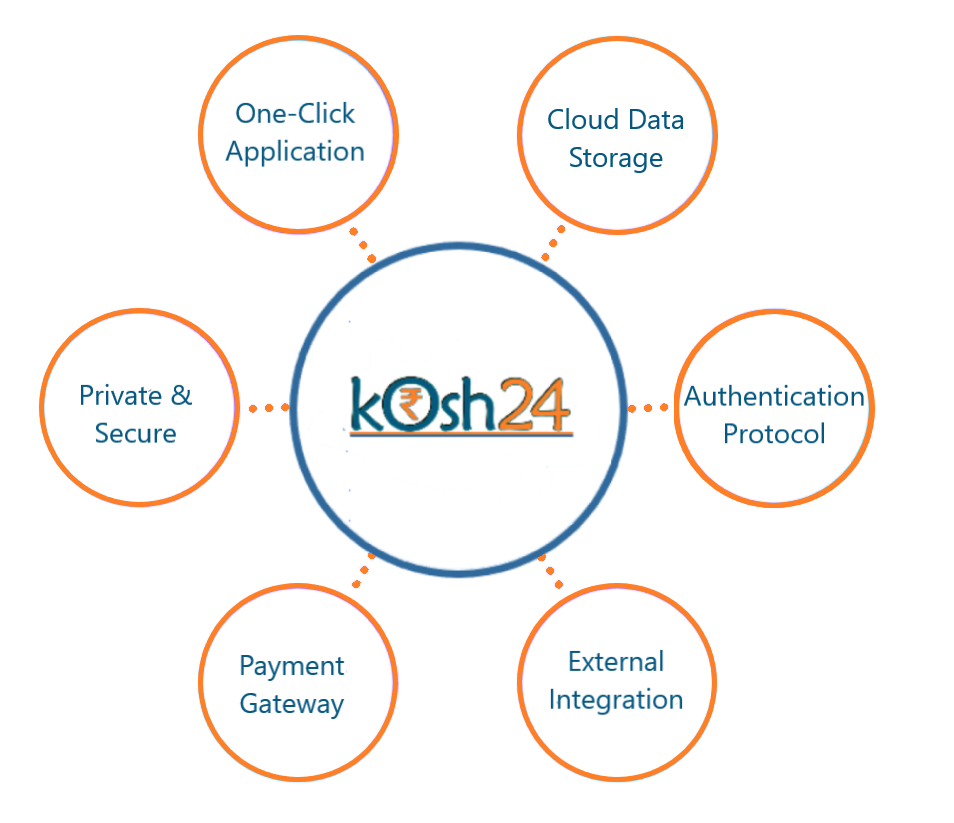

At kosh24.com, we are committed to simplifying the process of finding the perfect loan that meets your financial needs at most justifiable terms & conditions. We understand that every individual has unique financial requirements, and our goal is to assist & serve you with the best loan option with ease and convenience.

Our Vision:

Our vision is to be the go-to platform for Salaried, Self-employed, Professionals & Businesses seeking Various kind of Digital Loans. We strive to provide a seamless and user-friendly experience. We aim to tie-up with various RBI regulated financial institutions for fulfilment of lending requirements. We aim to empower you with the knowledge and tools needed to make informed borrowing decisions.

Why apply for a Loan on kosh24?

Instant personal loans

Instant personal loans from ₹50,000 to ₹25 lakh to fit all your needs

Quick Approvals & Disbursals

Get prompt loan approvals and money disbursed in your account

Completely digital process

Paperless Documentation end-to-end

Affordable EMI plans

Easily manage EMI plans with reminders and auto-debit feature so that you don’t miss out on timely payments

Zero Credit History

Never taken a loan previously? It’s okay - we serve users who are new to credit and lending ecosystem.

Apply for Digital Loans in easy steps

Eligibility Check

Fill in a few basic details & share basic documents to check your eligibility for our various loan programs. Choose the best combination of loan duration & EMI structure to select your loan plan.

Upload KYC Documents

To get your digital loan approval, you have to upload a few documents to complete your KYC etc. You are also required to sign the loan agreement and a eNACH form to enable auto-deduction of EMIs. Biggest advantage – entire process is digital/ paperless. Once all required documents are uploaded- you get an approval/ disbursement within a few working hours.

Get your money

Once your loan is approved and the application procedure is complete, your money will be directly transferred to your account quickly. It is that easy to get digital loans with kosh24's support.

Eligibility Criteria

- Indian Resident or India Registered Business

- Applicant Age: in case of Salaried: 21 years to 60 years

- Minimum Business Vintage in case of Business: 6 months

- Employment Type: Self-employed & Salaried

- Location: 1000+ cities

Documentation Required

- Proof of Identity: PAN Card & Selfie

- Proof of Address: Aadhaar card, Passport or Driving License

- Proof of Income: Net-Banking or last 12 months bank e-statements (Original PDF statement)

- Other Proofs: Business related documents

EMI Calculator

Loan EMI

Break-up of Total Payment

| Sr. No. | Date | Principal (₹) | Interest (₹) | Total Payment (₹) | Remaining Amount (₹) |

|---|